The Financial Transaction Services industry is expected to gain from a rapidly expanding digital economy. For devising an enhanced digital solutions suite, industry players often rely on mergers and acquisitions or technology investments. Favorable employment rates provide an impetus to consumer spending, which, in turn, drives transaction volumes. However, continued inflationary challenges are concerning. A significant increase in travel is likely to boost cross-border volumes of the industry participants. Companies like Visa Inc. V, Mastercard Incorporated MA, Fiserv, Inc. FI, Fidelity National Information Services, Inc. FIS and Equifax Inc. EFX are well-placed to gain from the industry’s encouraging growth prospects.

About the Industry

The Zacks Financial Transaction Services industry is part of the Financial Technology or the FinTech space, which includes companies with varying natures of businesses. The industry comprises card and payment processing, and other solutions providers, ATM services and money remittance service providers, and providers of investment solutions to financial advisors. Players in this segment operate their unique and proprietary global payment networks that link issuers and acquirers around the globe to facilitate the switching of transactions, permitting account holders to use their products at millions of acceptance locations. Monetary transactions are effectuated through these networks, offering a convenient, quick and secure payment method in several currencies across the globe. The industry is benefiting from the ongoing digitization movement triggered by the pandemic.

4 Trends Shaping the Fate of Financial Transaction Services Space

Widespread Adoption of Digital Payment Methods: Owing to the growing uptake of digital means across every sphere of life, financial transaction service players came up with advanced payment solutions, such as cryptocurrency, biometrics, QR codes and buy now, pay later solutions. The hassle-free and cost-effective nature of digital payments will continue to sustain its robust hold over the global payments market in the days ahead. In addition to benefiting consumers, the growing digitization provides an opportunity for industry participants to benefit from higher transaction volumes and, subsequently, an increased revenue base. A lucrative digital solutions suite does not only aim to simplify online payments but also ensures safety in such payments by rolling out fraud-prevention services. A higher Internet penetration rate and greater use of smartphones are expected to sustain the solid demand for digital payment methods in the days ahead. Per the market and consumer data provider Statista, the Digital Payments market is anticipated to strike a total transaction value of $11.55 trillion in 2024 and see a CAGR of 9.5% over 2024-2028. This provides the perfect ground for the industry participants to capitalize on.

Resilient Consumer Spending: Continued consumer spending implies increased utilization of product and service offerings of financial transaction services players. This, in turn, earns them higher revenues. Employment gains and the benefits of e-commerce shopping also drive consumer spending. In 2023, U.S. consumer spending fared well despite lingering inflation pressures. Further, favorable consumer spending boosted holiday sales in 2023, as furnished in MA’s SpendingPulse report. U.S. retail sales, excluding automotive, improved 3.1% year over year during the 2023 holiday season. Restaurant spending also climbed 7.8% year over year. These positive trends of consumer spending are creating a ray of hope for the industry participants in 2024 amid continued inflationary headwinds.

Pursuit of M&A Strategies: Apart from pursuing technology investments, merger and acquisition (M&A) strategies often become the means for devising a digital solutions suite. The strategy also gives an opportunity to the industry participants to foray into new markets, expand their foothold in existing ones, broaden partner networks and increase customer base. With the Fed signaling rate cuts in 2024, borrowing costs are likely to decrease, which will make it easier for financial transaction service players to opt for loans to enter M&A deals and continually upgrade their portfolios.

Solid Cross-Border Volumes: Increased travel by individuals, whether for business or recreational purposes, will likely boost cross-border volumes of companies in the financial transaction services space. With industrial and business activities back on track, the strong demand for international travel is likely to sustain in the days ahead. The industry participants, having exposure to the cross-border business, devise platforms, backed by an interconnected banking network and proven expertise in the seamless processing of digital payments. Industry participants also have efficient business travel solutions in place, which make flight bookings simpler.

Zacks Industry Rank Instills Optimism

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. The Zacks Financial Transaction Services industry is housed within the broader Zacks Business Services sector. It currently carries a Zacks Industry Rank #87, which places it in the top 35% of more than 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate.

Before we present a few stocks that you may want to buy or retain in your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

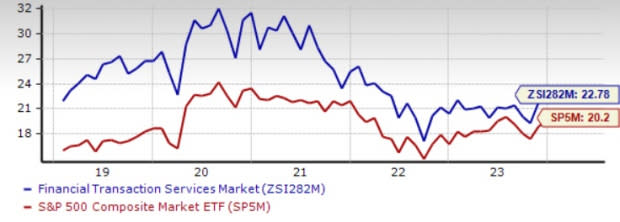

Industry Underperforms Sector, S&P 500

The Zacks Financial Transaction Services industry has underperformed its sector and the Zacks S&P 500 composite in the past year.

In the said time frame, the industry has gained 13.8% compared with the Business Services sector’s growth of 15.4%. The S&P 500 has rallied 20.9% in the same time frame.

One-Year Price Performance

Image Source: Zacks Investment Research

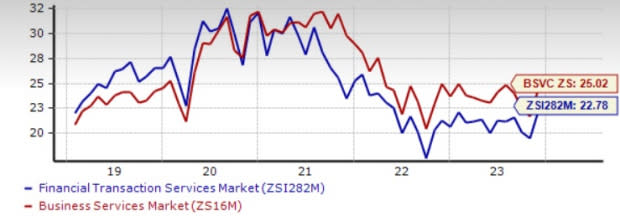

Industry's Current Valuation

On the basis of the forward 12-month Price/Earnings ratio, commonly used for valuing financial transaction services stocks, the industry is currently trading at 22.78X compared with the S&P 500’s 20.2X and the sector’s 25.02X.

Over the last five years, the industry traded as high as 32.49X, as low as 17.61X and at the median of 25.04X.

Forward 12-Month Price/Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

5 Stocks to Keep a Close Eye on

We are presenting five stocks from the Financial Transaction Services industry that currently carry a Zacks Rank #2 (Buy) or Zacks Rank #3 (Hold). Considering the current industry scenario, it might be prudent for investors to buy or retain these stocks in their portfolios, as these are well-placed to generate growth in the long haul.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

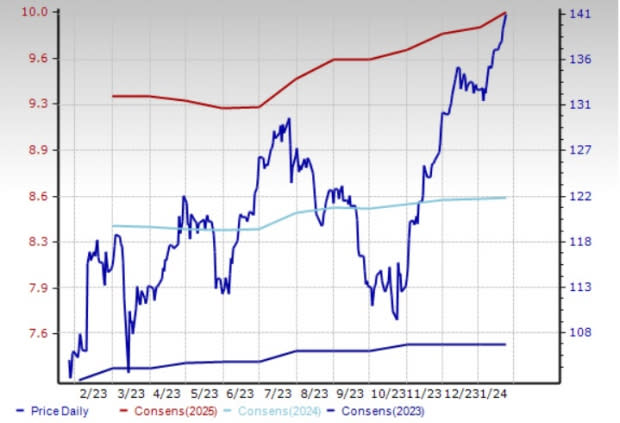

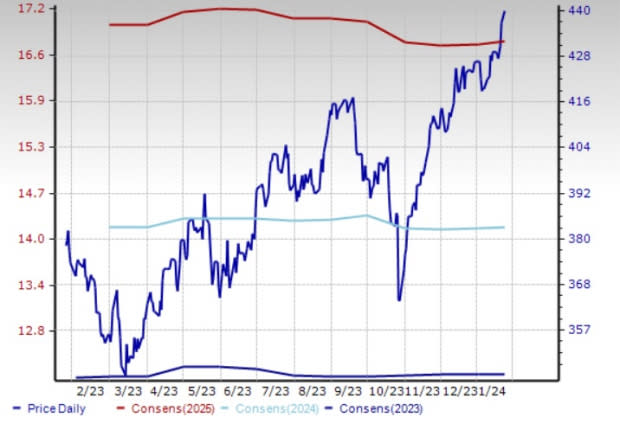

Fiserv: Based in Brookfield, WI, the company provides a varied array of products and services, including payment processing, core banking systems and digital banking solutions. This Zacks Rank #2 company introduces products and services to boost its customer base and address evolving market needs. FI resorts to acquiring businesses in a bid to boost business scale and achieve operational efficiency. Debt repayment, buyouts and share buybacks are the capital allocation priorities for management. Its shares have gained 35.5% in the past year.

The Zacks Consensus Estimate for Fiserv’s 2024 earnings is pegged at $8.58 per share, indicating a 14.7% rise from the 2023 estimate. The consensus mark for revenues implies a 7.9% improvement from the 2023 estimate. FI’s earnings beat estimates in two of the last four quarters and matched the mark twice, the average beat being 0.58%. Its shares have advanced 35.5% in the past year.

Price and Consensus: FI

Image Source: Zacks Investment Research

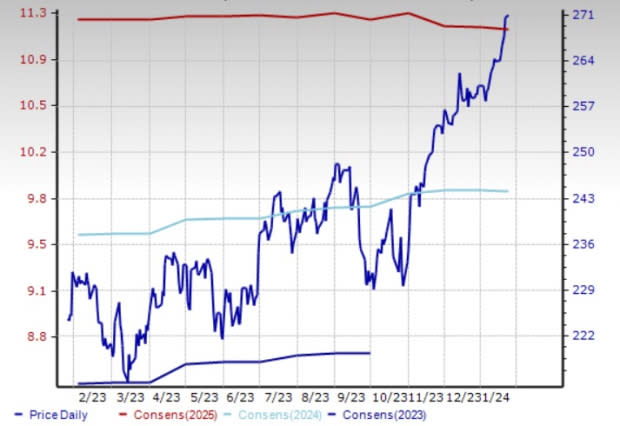

Visa: Based in San Francisco, the company is one of the world’s leaders in digital payments. It enters new deals, renews agreements and pursues accretive acquisitions in a bid to expand its network. Strong operations across Latin America, Canada and the United States contribute to growth of this Zacks Rank #3 company. Strong consumer spending fetches higher transaction processing fees and subsequently, improved revenues for Visa. It relies heavily on technology investments for building an advanced digital suite.

The Zacks Consensus Estimate for Visa’s fiscal 2025 earnings is pegged at $11.13 per share, indicating a 12.6% rise from the year-ago reported figure. The consensus mark for revenues suggests a 9.8% improvement from the year-ago actual. V’s earnings beat estimates in each of the last four quarters, the average beat being 5.35%. Its shares have gained 21.2% in the past year.

Price and Consensus: V

Image Source: Zacks Investment Research

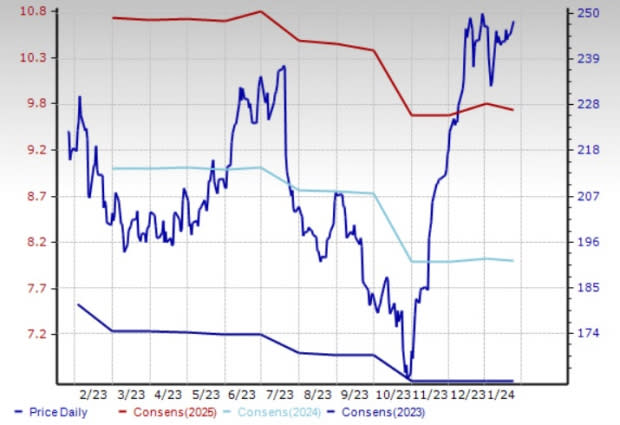

Mastercard: A solid digital suite of the Purchase, NY-based company, built through several collaborations with financial service providers and investments, has always positioned the tech giant well in harnessing booming digital growth prospects in various regions of the world. An uptick in travel provides a perfect opportunity for MA to capitalize on its efficient business travel solutions. This Zacks Rank #3 company has always utilized technologies and security protocols to devise solutions for seamless digital shopping experience.

The Zacks Consensus Estimate for Mastercard’s 2024 earnings is pegged at $14.20 per share, indicating a 16.7% rise from the 2023 estimate. The consensus mark for revenues suggests a 12.3% improvement from the 2023 estimate. MA’s earnings beat estimates in each of the last four quarters, the average beat being 3.55%. Its shares have risen 15.7% in the past year.

Price and Consensus: MA

Image Source: Zacks Investment Research

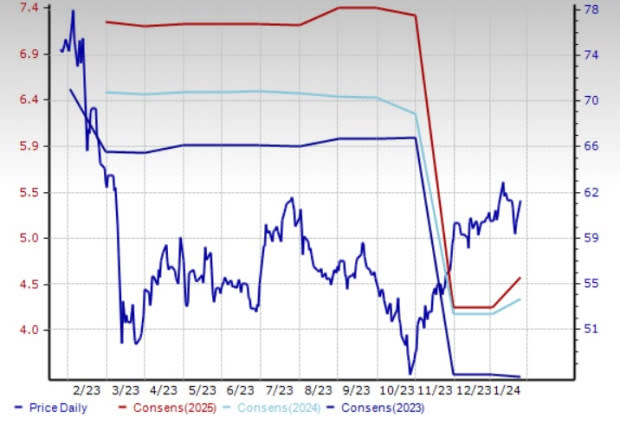

Fidelity National: The Florida-based FIS places an intensified focus on technological advancements, positioning it favorably for client acquisitions. The robust performances of the Banking Solutions and Capital Market Solutions segments are noteworthy. Fidelity National maintained an acquisition spree to bolster its footprint in various areas. Partnerships further augment market presence. Adequate cash-generating abilities enable the Zacks Rank #3 company to pursue business investments.

The Zacks Consensus Estimate for Fidelity National’s 2024 earnings is pegged at $4.33 per share, which indicates an improvement of 23.5% from the 2023 estimate. The consensus mark for revenues hints at a 3.2% uptick from the 2023 estimate. Even though its shares have declined 16.9% in the past year, solid fundamentals are likely to help shares bounce back in the days ahead.

Price and Consensus: FIS

Image Source: Zacks Investment Research

Equifax: Headquartered in Atlanta, the company gains from acquisitions and continued general consumer credit activity. EFX pursues cloud data and technology transformation efforts to bring about innovation and product development, as well as solidify customer and partner integration. Partnerships provide this Zacks Rank #3 company an opportunity to offer differentiated data assets and analytics.

The Zacks Consensus Estimate for EFX’s 2024 earnings is pegged at $7.99 per share, which implies a 20.3% rise from the 2023 estimate. The consensus mark for revenues suggests 8.9% growth from the 2023 estimate. Equifax’s earnings beat estimates in three of the last four quarters and missed the mark once, the average beat being 2.09%. Its shares have gained 12% in the past year.

Price and Consensus: EFX

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report

As an expert in the financial services and technology industry, I bring a wealth of knowledge and experience to the table. With a background in the analysis of market trends, mergers and acquisitions, and technology investments, I have a comprehensive understanding of the factors that shape the Financial Transaction Services sector.

In this article, the author discusses the Financial Transaction Services industry and highlights key players like Visa Inc. (V), Mastercard Incorporated (MA), Fiserv, Inc. (FI), Fidelity National Information Services, Inc. (FIS), and Equifax Inc. (EFX). The article explores various concepts related to the industry, including:

-

Industry Overview:

- The Financial Transaction Services industry is part of the broader Financial Technology (FinTech) space, encompassing various businesses such as card and payment processing, ATM services, money remittance, and investment solutions for financial advisors.

- Companies in this industry operate global payment networks facilitating transactions and enabling product usage at acceptance locations worldwide.

-

Industry Trends:

- The industry is benefiting from the ongoing digitization movement triggered by the pandemic.

- Widespread adoption of digital payment methods, including cryptocurrency, biometrics, QR codes, and buy now, pay later solutions, is driving higher transaction volumes and revenue growth.

-

Factors Shaping the Industry:

- Resilient consumer spending, driven by favorable employment rates and e-commerce, contributes to increased utilization of financial transaction services.

- Mergers and acquisitions (M&A) strategies and technology investments are common approaches for industry players to enhance their digital solutions suite and expand market presence.

-

Cross-Border Volumes:

- Increased travel is expected to boost cross-border volumes for companies in the financial transaction services space.

- Companies with exposure to cross-border business leverage interconnected banking networks and expertise in seamless digital payment processing.

-

Zacks Industry Rank:

- The Zacks Industry Rank for the Financial Transaction Services industry is #87, positioning it in the top 35% of more than 250 Zacks industries.

- The article suggests optimism based on the industry's Zacks Industry Rank, although it notes a negative earnings outlook for constituent companies.

-

Market Performance and Valuation:

- The industry has underperformed its sector and the S&P 500 composite in the past year.

- The one-year price performance indicates a 13.8% gain for the industry.

- Valuation metrics, such as the forward 12-month Price/Earnings ratio, show the industry trading at 22.78X, compared to the S&P 500's 20.2X and the sector's 25.02X.

-

Stock Recommendations:

- The article recommends five stocks from the Financial Transaction Services industry: Fiserv (FI), Visa (V), Mastercard (MA), Fidelity National (FIS), and Equifax (EFX).

- Each stock is accompanied by relevant financial information, including the Zacks Consensus Estimate for earnings and revenues, as well as the forward 12-month Price/Earnings ratio.

In conclusion, the Financial Transaction Services industry is positioned for growth, driven by digitalization, consumer spending, M&A strategies, and cross-border volumes. Investors are advised to consider the recommended stocks based on their potential for long-term growth.